Welcome to the second post in our weekly industrial marketing series to help you prepare an actionable, effective, and measurable marketing plan for 2023–24.

If you’ve just entered the room and missed last week, you can catch up here on the Week 1 article.

For those who got through last week’s tasks, you’ll have gathered whatever information you had available on your:

- customers

- products and services

- market and business environment (competitors, market trends)

- past performance (i.e. results of previous marketing activity, campaigns, etc)

- current systems and resources.

All this information will help you to conclude the diagnosis part of your planning process.

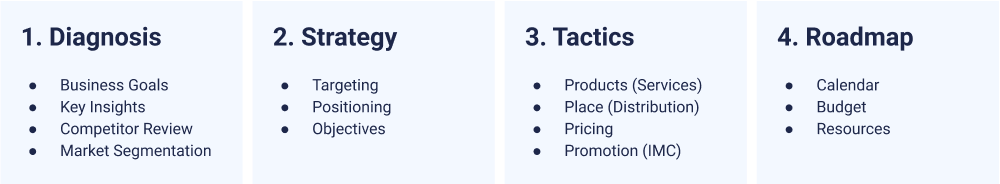

Remember this model?

Since you already worked on your business goals last week, in this post we’ll be taking a look at the other three items under “Diagnosis”. But first...

Important note!

We don’t want you to get stuck on diagnosis. You might think you have a lot of questions that need answering and research to conduct, but with such a short time before the new financial year, we are focusing on a rapid diagnosis method. As well as speeding up your marketing plan for 1 July, it will help you determine what research you might do in the future, when you have the time and resources. Don’t forget to put that into your plan.

As we go through the following questions and resources, you should gradually build a unified document that fully diagnoses your current situation.

Key insights

Your key insights will come from a number of sources.

Customers

If you are market oriented, the most important insights you’ll uncover are from customers. You don’t have to put your business on hold while you run (and pay for) massive research projects, but you can do simple interviews of a few key customers, or talk to your sales or service teams. This can help separate fact from fiction, and real customer needs from internal assumptions. You’ll need to answer questions like:

- Who are our key customers? And when did we last actually talk with them?

- What do we know about them aside from their purchase history?

- What are the stages in their buying journey?

- What can we do in the short term to know them better? (e.g. phone calls, interviews, chat over coffee)

- What are customers saying to the sales or customer service teams about our offerings, their experience, or others in the market?

- How important are different company/product/brand attributes in customer decision making?

- How do different customer groups behave, especially in different stages of the customer journey?

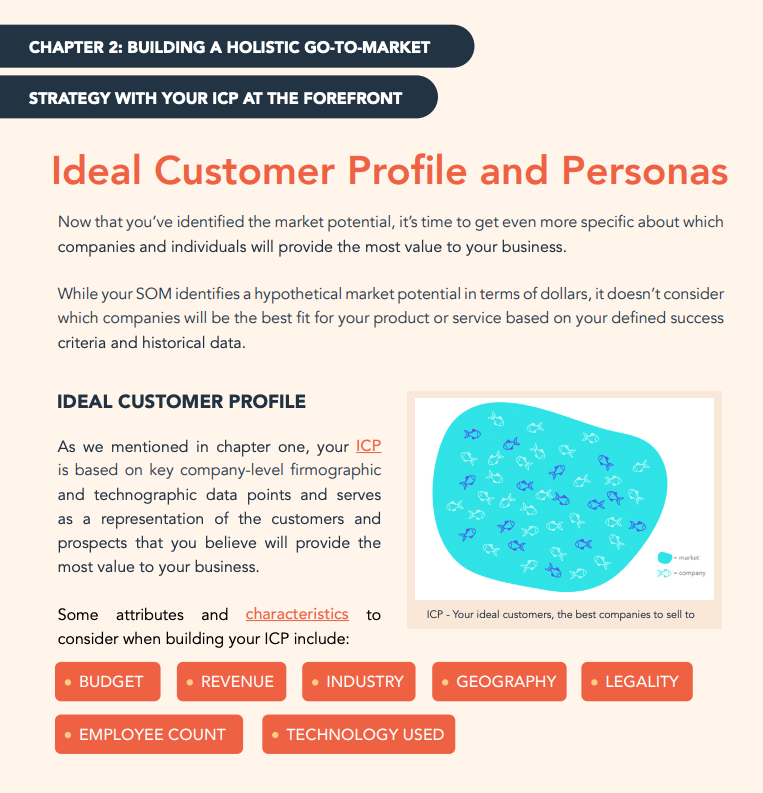

Talking to real customers helps deepen your understanding of them, so you can develop what an Ideal Customer Profile (ICP) for each group of similar customers. Here are a couple of tools to help you do that:

- Ideal Customer Profile Workbook, from HubSpot

- Buyer Personas tool, from HubSpot (personas are about individuals, rather than companies, but this interactive tool can be used as a quick way to develop a profile).

Products and services

You'll also want to have a clear idea of you product and service offering, how each is performing, how they align to customer needs, what new product development is planned or needed. Here's some questions:

- What are all the products and services we have?

- What special or unique features do these products or services have?

- For each special or unique feature, do they solve a problem for customers or meet some real need? How?

- Are there some products or services that take up a lot of company time but are not very profitable? If so, is there a compelling reason to maintain this product or service?

- Are there any insights regarding pricing for our product/service?

One useful way to define your product range and the benefits offered beyond the tangible, is to map them using the Augmented Product model.

Past Performance

It’s said that those who don’t learn from history are doomed to repeat it. The key here is to analyse the performance of your previous marketing efforts, so you for each you can determine whether you should do it again:

- do the same again

- do even more of what you've done

- do it again, but with changes, improvements

- avoid it, don't do it again

For any marketing activity, campaign or project you ran, you should answer these kinds of questions:

- What was the goal of the campaign?

- Who was it targeted at?

- What was the core messaging?

- What content and channels did we use?

- What results did it achieve?

- Was there a proven ROI? Do we consider it successful?

- Any key learnings?

- Should we do it again?

Beyond campaign analysis, you could also be looking more broadly across the customer funnel and marketing channels in general:

- How did we perform across the funnel: visitors, qualified leads, RFQs, proposals sent, deals won, up-sell or cross-sell?

- Do we have any feedback from customer service on issues with products and services?

- What channels (website, email, social, ads, video, etc) have been most effective?

Current systems and resources

You should also review what resources you have available to effectively deliver the marketing plan, in terms of people and software systems:

- Efficient (and sufficient) people (internal staff, agency partners, contractors), with the right mix of skills. If not, what changes do we need?

- What tech stack do we currently have (marketing, sales, customer service, website). Do we have any gaps? Have there been any problems or limitations?

Take a look at this article on key marketing skills for different organisation types and sizes. In SMEs, often a mix of external agencies/contractors and in-house staff is an effective and practical way to execute marketing resourcing.

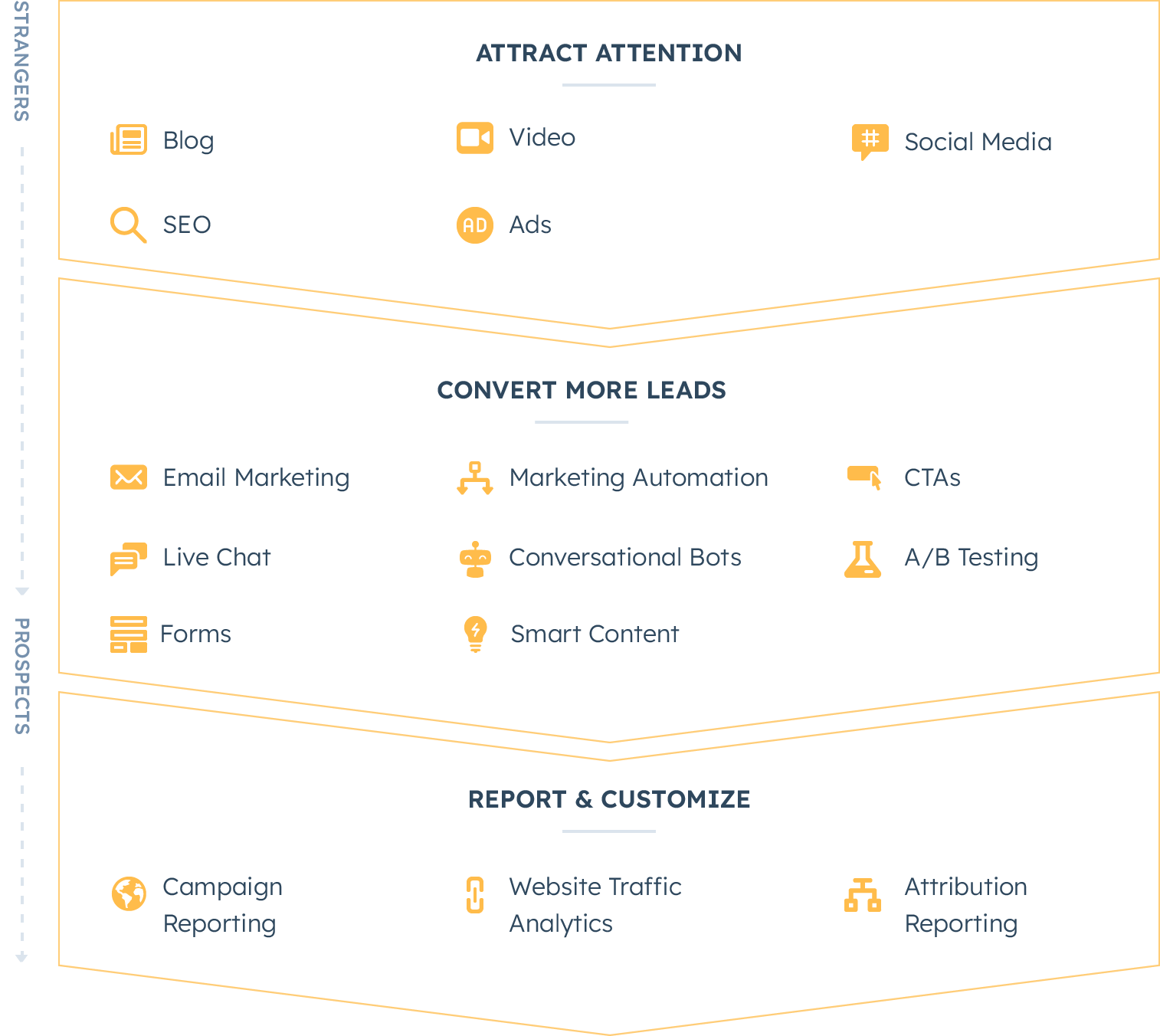

And whether you’re working from scraps of paper or a modern CRM, it’s worth comparing your current systems with this article on Why choose HubSpot, as it details the different marketing, sales and service tools needed across the stages of the customer lifecycle (see the below image as an example).

Market and Competitor review

There are many questions to ask about your competitors and the market:

- What is the total size of the market I am in?

- What changes have occurred in the market since my last review?

- What is the likely market direction in the future? Growth, steady or decline?

- Who are our competitors?

- What is the market share of our company and our competitors?

- Which competitors are gaining market share, and which are losing?

- What are my competitors doing, or likely to do?

- What is the business environment likely to be over the next 12 months?

- What type of customer profiles are in the market?

To can use the Context Map tool to map the market environment for your business.

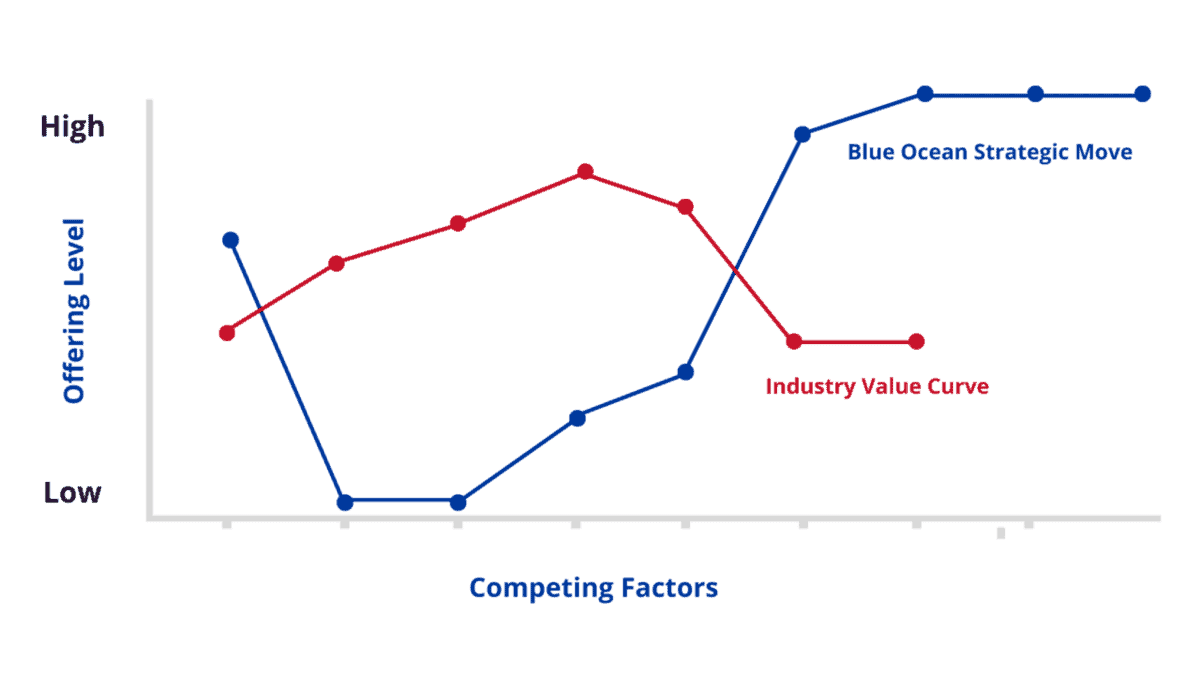

And there are plenty of tools you can use to map your competitive positioning visually, like the Blue Ocean Strategy canvas or a classic Competitive Matrix.

The Blue Ocean Strategy Canvas

Segmentation

Finally we come to segmentation. This is not about your product. It’s about the reality of the market you are in. You want to build a picture of that market, divided into groups or customers with common traits, needs and buying patterns. They will be like-minded in many ways, face similar challenges, and have common behaviours.

To make segmentation easier, it usually helps to combine all your research together with different possible ways of segmentation:

- demographic or firmographic (for companies)

- geographic

- behavioural

- psychographic

Then for each segment described, you need to find (or calculate) the:

- percentage of the market it occupies

- size in number of companies, revenue or other relevant measure

- your current market share

You can use a template to map all this out and represent your segmentation visually.

By experimenting with different segmentations, you’ll come to a picture that not only shows segments not being targeted, but also which segments are currently in your competitors’ sights.

This will help guide the strategic choices you will make next week.

Summary

Don’t panic. Anything you can do to progress your marketing before EOFY is a positive step.

To prepare for next week, make sure you:

- work through the above questions and collate your answers in a single document or table

- explore the tools and make use of them as much as time will allow

- above all, ensure you complete the segmentation model.

This will set you up nicely for next week’s session on marketing strategy.